The Economic State Of Latinos In The US: Determined To Thrive

US Latinos account for the fastest-growing portion of US GDP. So much so, that if we considered US Latinos as their own country, it would be third only to the GDP growth rate of China and India in the past decade.1 At a time of economic uncertainty with concerns about a possible recession growing, consumers are looking for additional support. Our research estimates that the Latino consumer base has unmet needs of more than $100 billion currently, and this could grow six-fold to $660 billion if we address the parity gap between Latinos and non-Latino Whites based on share of population

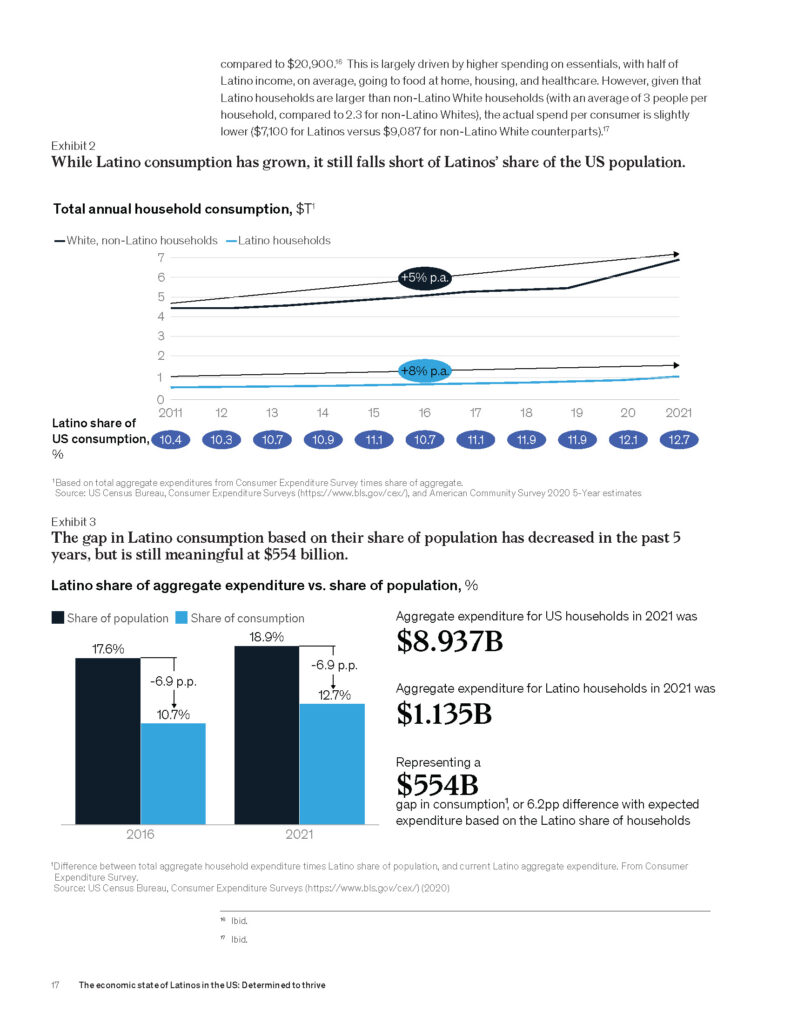

Over the past decade, Latinos have grown their household consumption to reach a cumulative $1 trillion market in 2021—a 6 percent annual growth rate over the last decade. Their household spend is higher compared to other groups at similar income levels, and yet marketing spend directed at Latinos most likely does not reflect this.2 Latinos are conscious of their impact, choosing brands that value the environment and their employees, all of which makes them more influential than their income levels would suggest.

However, Latino consumers are often highly dissatisfied with the products offered to them—especially compared to their non-Latino White counterparts. This dissatisfaction ranges across product categories, from food and beverages to financial products, which may point to unresolved needs that impact their daily life. If brands address the drivers of dissatisfaction in terms of access and value proposition, there is a collective $109 billion of revenue at stake, when considering current spending and future potential should improved products be offered.

Latino voices remain underrepresented in the C-suites of corporate America where product offerings and capital allocation decisions are made, and this is particularly true of Latina women. As a result, Latino consumers are often overlooked by companies that do not recognize them as a priority demographic. Less than 5 percent of seats in Fortune 500 boards and in C-suites of corporate America are occupied by Latinos despite this community representing 19 percent of the US population.3 Latina women hold 1 percent of seats in Fortune 500 boards, the smallest percentage of board seats compared to any racial or ethnic demographic in the United States.4 Furthermore, Latina women may be further marginalized at work as described in our latest Women in the workplace report.5

Closing The Latino Wealth Gap Would Strengthen The Existing Consumer Opportunity By More Than 500 Percent

In a scenario in which Latinos match their spend to their share of population, Latino consumers would spend around $554 billion more than today. Closing this gap would require addressing the underlying income and savings gaps between Latinos and non-Latino Whites. Employers and society at large have much to gain from providing Latinos with better jobs that also provide advancement and leadership opportunities.

In pursuing greater prosperity and fulfilment, Latinos increased their share of professional roles to 25 percent—a five percentage point gain over the past decade. However, Latinos still face barriers in the workplace, through discrimination, implicit biases, or a lack of opportunities for advancement in new roles. In fact, if Latinos were represented at job levels in line with their share of the population, and paid the same as non-Latino Whites, they would receive an additional $281 billion in annual income that could be further deployed to drive economic growth.6

Latino savers have only a fifth of the median wealth of their non-Latino White counterparts, and their savings have been depleted; today, almost half of Latinos have little or no retirement savings. Only 23 percent of Latinos are considered financially healthy in 2022 compared to 35 percent of non-Latino Whites. Nevertheless, Latinos’ net wealth is increasing at a faster rate (9 percent for Latinos, versus 4 percent for non-Latino Whites), narrowing—but not yet closing—the gap with non-Latino Whites. If the trend continues, Latino households could reach an average net worth of $47,000 this ye

ABOUT THE AUTHOR(S)

Ana Paula Calvo is a consultant in McKinsey’s Miami office, where Carolina Mazuera is an associate partner; Jordan Morris is a consultant in the Chicago office, where Bernardo Sichel is a partner; and Lucy Pérez is a senior partner in the Boston office.

![]()